How Does Gap Insurance Work? Everything You Need to Know

My close friend was so excited to finally get that new car she’s been eyeing on since it came out. So she finally did, that fresh-off-the-lot smell, shiny paint and wrapped interior. But on the other end was a nerve-racking feeling, what if it got totaled or stolen before she finished paying it off.

I calmed her down because that’s where the gap insurance she got beforehand will take care of that. In my friend’s case, she was lucky she got me and I talked her into getting it. But to many, they might have heard the term tossed around by a dealer or lender, but what exactly does it do? More importantly, how does gap insurance work, and is it something you actually need?

What Is Gap Insurance?

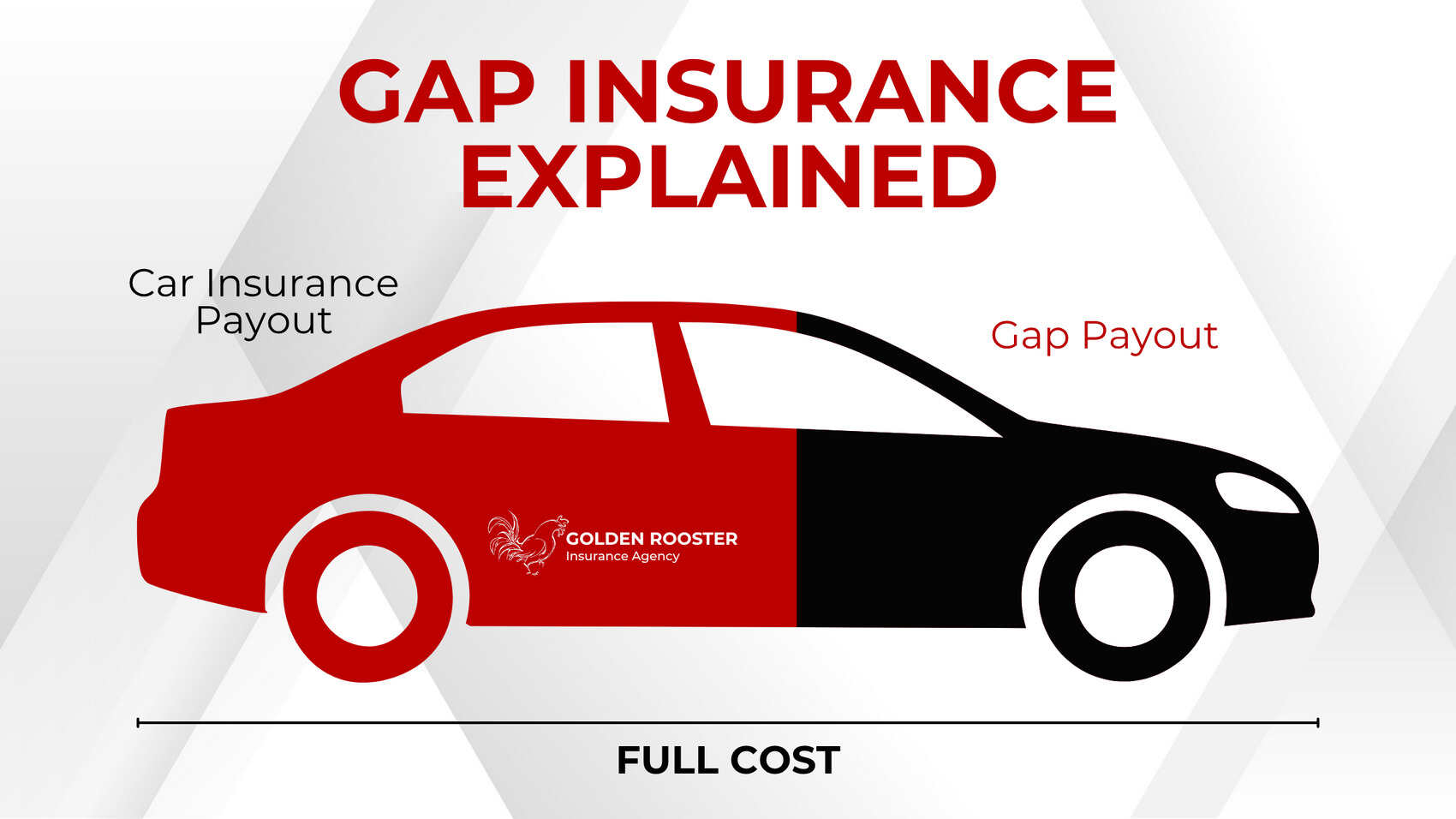

Short for Guaranteed Asset Protection, it is designed to cover the difference between what your car is worth and what you still owe on your loan if the vehicle is totaled or stolen.

Here’s why that matters: cars lose value fast. The moment you drive off the lot, your new car’s value starts to drop, sometimes by as much as 10% in the first month and up to 20% in the first year.

Let’s look at a simple example:

- You buy a new car for $35,000.

- A year later, it’s worth $28,000 (its actual cash value, or ACV).

- But you still owe $32,000 on your loan.

- If your car is totaled in an accident, your standard auto insurance pays the ACV, $28,000, leaving you with a $4,000 gap. That’s money you’d still owe to your lender, even though your car is gone.

Gap insurance covers that $4,000 difference so you can walk away debt‑free.

Why Car Loans & Leases Create a Risky Gap

Most modern car loans and leases are structured in ways that make this “gap” likely, especially early in ownership.

- Depreciation Happens Fast

Cars are depreciating assets. The value of a new car can drop by 15–25% in the first year alone. Some makes and models lose value even faster, especially those with heavy incentives or high production volumes.

- Small Down Payments Are Common

Many buyers put little or no money down, sometimes just enough to cover taxes and fees. That means you’re financing almost the entire purchase price, so your loan balance starts out higher than your car’s resale value.

- Long‑Term Loans Stretch Out the Risk

To keep monthly payments low, more people are choosing 72‑ or even 84‑month loans. The longer the term, the slower you build equity, and the longer you stay “upside‑down.”

- Leases Automatically Include a Gap

If you lease, you don’t own the car at all; you’re paying for its depreciation. That’s why most lease contracts require gap insurance by default.

In short, negative equity (owing more than your car is worth) is common, especially in the first few years. Gap insurance exists to protect you during that vulnerable period.

How Does Gap Insurance Work – Step by Step

Let’s walk through exactly how gap insurance works when the worst happens — your car is declared a total loss.

Step 1: You file a claim with your primary auto insurer.

After an accident or theft, your regular auto insurance company assesses your car’s actual cash value (ACV), what it was worth right before the incident.

Step 2: The insurer pays you (or your lender) the ACV.

Let’s say your car’s ACV is $20,000, but you still owe $25,000 on your loan. Your insurer sends $20,000 to your lender.

Step 3: You’re left with a $5,000 balance.

Without gap insurance, that $5,000 remains your responsibility — even though your car is gone.

Step 4: Gap insurance covers the difference.

Your gap policy steps in and pays that remaining $5,000 directly to your lender. You walk away with a clean slate.

What Gap Insurance Doesn’t Cover

It’s just as important to know what gap insurance doesn’t do:

- It doesn’t cover repairs or partial losses.

- It doesn’t pay for medical bills or injuries.

- It doesn’t cover new car replacement (that’s a separate coverage).

Gap insurance only applies when your vehicle is declared a total loss and your loan balance exceeds its value.

Who Needs Gap Insurance Most?

Gap insurance isn’t for everyone — but for some drivers, it’s a financial lifesaver. Here’s who benefits the most:

- You Lease Your Vehicle

Leasing companies almost always require gap coverage because you’re responsible for the car’s depreciation. In most cases, it’s already rolled into your lease contract.

- You Made a Small Down Payment

If you put less than 20% down, you likely owe more than your car is worth for at least the first couple of years.

- You Have a Long‑Term Loan

Loans longer than 60 months make it harder to build equity quickly. The slower you pay down the principal, the longer you’re exposed to negative equity.

- You Bought a Rapidly Depreciating Vehicle

Some vehicles, especially luxury cars, electric vehicles, or models with frequent redesigns, lose value quickly. Gap coverage can protect you from that steep drop.

Who Probably Doesn’t Need It

- You own your car outright.

- You made a large down payment (20% or more).

- You have a short‑term loan (36 months or less).

- Your car holds its value well.

In these cases, your loan balance and your car’s value are likely close enough that a total loss wouldn’t leave you owing much, if anything.

Pros & Cons at a Glance

Let’s weigh the main advantages and drawbacks of gap insurance so you can decide if it fits your situation.

When to Drop Gap Coverage

Gap insurance isn’t meant to last forever. Once your car’s market value equals or exceeds your loan balance, you can safely cancel it.

Here’s how to tell when it’s time:

- Check your loan payoff amount.

- Contact your lender for the exact balance you owe.

- Look up your car’s current value.

- Use tools like Kelley Blue Book (KBB) or Edmunds to estimate your car’s ACV.

- Compare the two.

- If your car’s value is higher than your loan balance, you no longer need gap coverage.

Pro Tip: Request a Prorated Refund

If you purchased gap coverage upfront (for example, through a dealership or lender), you may be eligible for a partial refund when you cancel early. Contact your provider to check their policy.

By dropping gap insurance at the right time, you’ll save money while still staying protected when it matters most.

FAQs About Gap Insurance

- Can I buy gap insurance after I buy my car?

Yes. Many insurers allow you to add gap coverage within the first few years of financing your vehicle. However, some lenders or dealerships require you to purchase it at the time of financing.

- Is gap insurance required by law?

No, it’s not legally required. But lenders or leasing companies may make it a condition of your contract.

- Does gap insurance cover theft?

Yes. If your car is stolen and not recovered, gap insurance covers the difference between your loan balance and your insurer’s payout.

- Can I get gap insurance if I bought my car with cash?

No need, if you own your car outright, there’s no loan balance to protect.

- Does gap insurance cover new car replacement?

No. Gap insurance only pays off your loan balance. If you want a brand‑new replacement vehicle, look into new car replacement coverage, which some insurers offer separately.

Real‑World Example: How Gap Insurance Saves You

Let’s say you financed a $40,000 SUV with a small down payment and a 72‑month loan. After a year, your SUV’s value drops to $33,000, but you still owe $38,000.

Then, an accident damages your vehicle.

Your auto insurer pays the ACV: $33,000.

You still owe $38,000 on your loan.

That leaves a $5,000 gap.

Without gap insurance, you’d have to pay that $5,000 out of pocket, for a car you no longer have.

With gap insurance, that $5,000 is covered, letting you start fresh with your next vehicle.

Where to Buy Gap Insurance

You have a few options when it comes to purchasing gap coverage:

- Through Your Auto Insurer

This is often the most affordable route. Many major insurance companies offer gap coverage as an add‑on to your existing policy.

- Through Your Lender or Dealership

While convenient, this option can be more expensive. The cost is often rolled into your loan, meaning you’ll pay interest on it over time.

- Through a Standalone Provider

Some specialty companies sell gap insurance directly. This can be a good choice if your insurer doesn’t offer it or if you want to shop for the best rate.

How Much Does Gap Insurance Cost?

The cost of gap insurance depends on where you buy it and your vehicle’s value. On average:

- Insurer add‑on: $50–$150 per year.

- Dealer or lender add‑on: $400–$700 (one‑time fee, often rolled into your loan).

- To get the best value, compare quotes from your insurer before agreeing to a dealership‑added policy.

Tips for Getting the Most from Your Gap Insurance

- Buy early. The best time to add gap coverage is right after purchasing or leasing your car.

- Review your loan regularly. Check your balance and your car’s value every 6–12 months.

- Drop it when it’s no longer needed. Once your car’s value exceeds your loan balance, cancel and save.

- Bundle with your auto insurance. Adding gap coverage to your existing policy can simplify billing and claims.

Final Thoughts

Having an understanding of how gap insurance works can save you from any unpleasant financial surprise. It may be simple, but it can be your powerful safety net, the kind that keeps you from paying thousands out of pocket if your car is totaled or stolen before you’ve paid it off.